My February 2015 NARI Legal Corner guest blog titled Build a Record You’ll Be Proud Of, addressed the importance of recordkeeping for contractors and provided practical guidelines for creating project records. It showed that the successful management of construction projects requires proper management of a company’s records and other “information assets.” Information asset management should be viewed as a key component of every contractor’s overall risk management program. The article concluded by recommending that organizations develop and implement a document retention policy and legal retention schedule, which together allow old records to be destroyed in a legally defensible manner. This article describes an approach to managing and retiring (destroying) information assets that is based on industry standards and best practices.

A document retention policy is really a document destruction policy

Information as Assets

Broadly defined, information assets include not only project records, accounting records and official documents but all other information holding any value or representing any risk to the organization. Information assets include anything that is recorded or stored such as email, instant messaging, voicemail, databases, digital photos or any type of document, whether printed out or not. Assets in the form of Electronically Stored Information (ESI) also include the “metadata” associated with each electronic file. Metadata is defined as data about data. For example, computer files contain hidden metadata about the file such as: when it was created, who created it, when it was last accessed and by whom. Email contains even more metadata, including the computer address of the sender, how it was routed, who was bcc’d, etc.

The reality that assets can either be valuable or present a risk is easily demonstrated. Documents and records that prove a right to payment or successfully defend against a claim are valuable. On the other hand, saving every employee email forever may create a liability. If there is ever a lawsuit, investigation or audit, your attorneys will need to search through and review everything you have that might be relevant. Generally, the cost of such document review will be borne by your organization. If you are subpoenaed, you will have to bear the cost of producing your electronically stored information (ESI).

The other source of risk is where there are so-called “smoking guns” hiding in your email. Smoking guns range from an ill-advised comment that admits liability (“Oops, we installed the wrong pipe”), to evidence of a cover up or fraud (“Don’t tell the customer that we installed the wrong pipe”). Basically, a smoking gun is anything that you would not want disclosed to an opponent or government investigator. Pro-tip: lawyers search for cuss-words during eDiscovery.

Why keep things around that you don’t need, that cost you money and that might hurt you? The most important thing to understand is that relevant email and electronic documents are discoverable in litigation and arbitration. Some of the types of documents that may be subject to a discovery request in a construction case include:

- General contracts, subcontracts, design contracts, supply contracts, documents related to project financing;

- Other Contract Documents;

- Side agreements;

- JV agreements;

- Correspondence;

- Documents related to the owner’s interest in real property for the project;

- Insurance documents;

- Surety bond documents;

- Business information about the structure and ownership of contracting parties;

- Organizational charts;

- Design documents and contracts allocating design responsibility among consultants;

- Geotechnical reports and site inspection documentation;

- Documents dealing with site inspections;

- Daily reports, field reports, project photographs, web cam data;

- Bid packages and scopes of work for subcontractors, suppliers, etc.;

- Lien notices;

- Estimating work files, GMP work files;

- Email including personal email accounts used for project at home stored on any computer;

- Document Retention Policy;

- Information regarding IT infrastructure and location of all ESI relevant to project;

- Transmittal and other Logs;

- Meeting minutes (including recordings, if made)

- CORs and backup files;

- RFIs

- Subcontractor invoices;

- Payment applications and backup work files;

- Schedules and analyses;

- Cost accounting records;

- Timesheets and records, certified payroll records;

- Test results;

- Employee information such as resumes

Depending on the specific issues raised in the dispute resolution, gathering, reviewing and producing this information can be as expensive and onerous as it appears. However, if records and other documents that could be subject to discovery are well organized and segregated from those that may be privileged or confidential, then discovery is more likely to run smoothly and not disrupt the core responsibilities of the organization. This type of planning can result in a demonstrable return on investment (ROI) and should be contemplated as part of a document retention policy.

Document Retention Policies

A document retention policy is in reality a document destruction policy. A document retention policy should cover records as well as nonrecord documents, and electronically stored information (ESI). An organization can create a reasonable policy that allows for the destruction of its records and other documents after those items have no further usefulness to the organization. This is valid and legal according to the U.S. Supreme Court. A document retention policy must be reasonable. And, it is just as important that it be followed consistently. Document retention policies should cover traditional paper documents as well as email and other forms of ESI. There is no one size fits all policy.

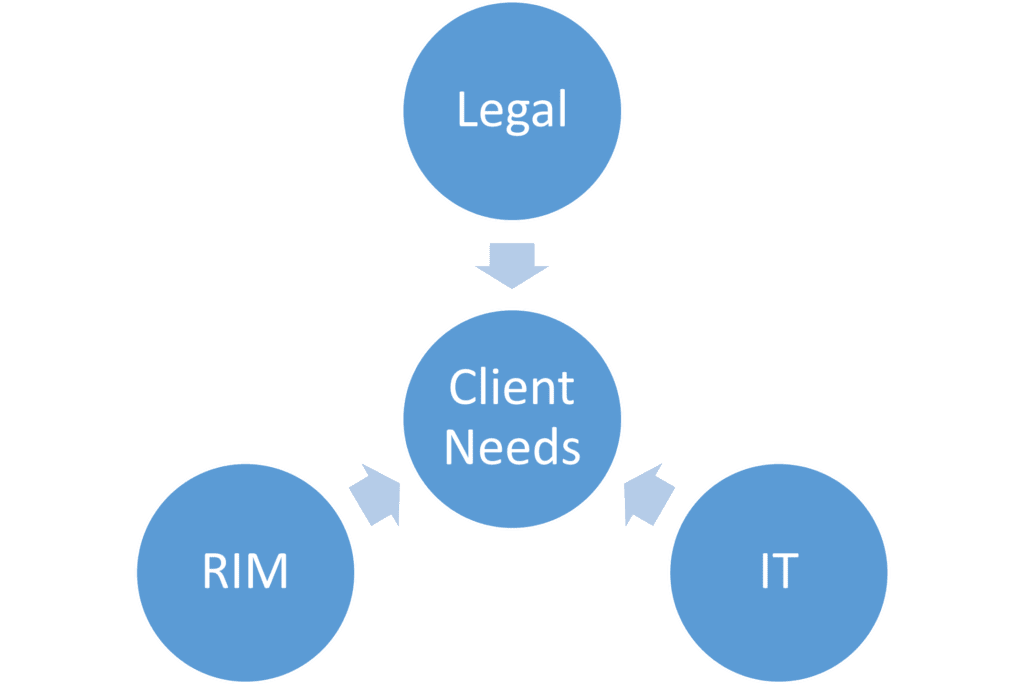

Generally the policy should be developed by a team with the input of legal counsel, Records and Information Management (RIM) professionals and the key managers of the organization. The multidisciplinary team approach recognizes that a document retention policy is an investment in the management of information as a business/organizational asset. A document retention policy can greatly reduce the costs of electronic discovery and legal fees for any organization that is subject to litigation, arbitration, audit or investigation.

While each document retention policy must reflect the particular needs and risk environment of the organization, there are a number of standards and guidelines that help avoid “reinventing the wheel.” The following organizations publish information concerning the records management, legal, information technology and other elements of a document retention policy:

- ARMA International

- AIIM

- The Sedona Conference

- ISO

- MoReq

- DoD

- Industry Specific (e.g., NSPE)

Structure of Policy

A document retention policy has a number of important basic attributes:

- Valid until trigger of “legal hold” (see below)

- Business purpose

- Measured by good faith and reasonableness

- Cost management of information assets

- Compliance with laws

- Reduce attorney review costs

- Legally defensible removal of “smoking guns”

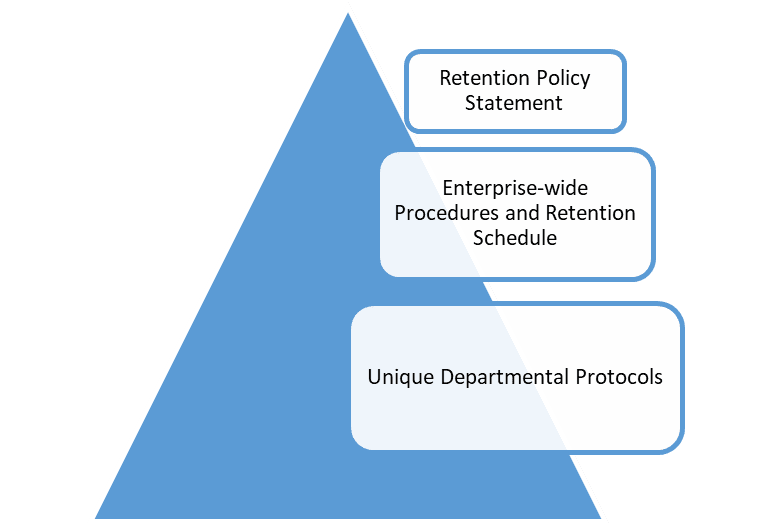

A document retention policy involves much more than a two page statement of good intentions cribbed from the internet. The policy needs to be supplemented with a records retention schedule containing citations to the legal authority for each retention period. It should also include specific procedures and protocols governing the creation, use, storage and destruction of both official records and non-record documents. The overall policy statement can be short and general. Specific departments, such as HR or finance can have more detailed procedures that need not apply throughout the organization.

Ultimately, the objective of a document retention policy is to create a reasonable system to retire or destroy records and documents that are no longer required to be kept by the law, contract obligations. or business needs. A reasonable document retention / destruction policy, followed consistently and in good faith, allows an organization to lower storage costs, reduce liability and destroy records and documents that are no longer of value or that present a risk.

Legal Hold is an Exception to a Document Retention / Destruction Policy

The document retention policy, procedures and protocols must include provisions for the identification of events or knowledge triggering the duty to implement a “legal hold.” A legal hold suspends the destruction of relevant records and documents. The need for a legal hold arises out of the common law doctrine prohibiting destruction of evidence (also called “spoliation” of evidence). Once you have notice of a triggering event or reasonably anticipate one, your organization is under a legal duty to preserve evidence, even if it is otherwise scheduled to be destroyed under a valid document retention policy.

Some of the “triggers” are obvious: getting sued, deciding to sue, receipt of a subpoena, notification of an audit, notification of a government investigation, a workplace accident, or receiving a credible threat of a lawsuit or arbitration. However, the triggers for the duty to preserve depend heavily on facts and circumstances and legal counsel should be consulted in the early stages of a dispute. Each implementation of a legal hold should be documented with records of its own to ensure that the efforts were reasonable.

There is a developing case law on the topic and organizations such as The Sedona Conference have issued guidelines and best practices. Judge Sheindlin, one of the best informed jurists on this topic, wrote a series of opinions dealing with electronic discovery in an employment case named after the plaintiff Zubulake. Her standards in one of the cases are quite instructive:

First, counsel must issue a “litigation hold” [aka legal hold] at the outset of litigation or whenever litigation is reasonably anticipated. The litigation hold should be periodically reissued so that new employees are aware of it, and so that it is fresh in the minds of all employees.

Second, counsel should communicate directly with the “key players” in the litigation, i.e., the people identified in a party’s initial disclosure and any subsequent supplementation thereto.

Finally, counsel should instruct all employees to produce electronic copies of their relevant active files. Counsel must also make sure that all backup media which the party is required to retain is identified and stored in a safe place.

Zubulake v. UBS, 229 F.R.D. at 422 (“Zubulake V”)

The 11 Guidelines published by The Sedona Conference (Commentary on Legal Holds: The Trigger and the Process, 2010, available at www.thesedonaconference.org), echo Judge Sheindlin’s principles. The key takeaway from the Guidelines is that organizations must take actions that are reasonable, in good faith and proportional to nature of the dispute.

Legal Hold is Temporary

The final key concept is that a legal hold is not permanent. Once the reason for the trigger no longer exists, as when the lawsuit settles, or the threat is actually removed, the records and documents covered by the specific legal hold can return to their normal retention / destruction schedules under the document retention policy. As with any legal issue, it is important to seek out specific legal advice from a competent attorney.